Higher education in the United States can be expensive, but financial aid programs, including grants, can help ease the burden. Unlike student loans, grants are a form of financial assistance that does not need to be repaid, making them an excellent resource for students looking to fund their college education.

If you’re a college student or planning to attend college, it’s crucial to understand the different types of grants available and how to apply for them. This guide will walk you through everything you need to know about grants for college students in the USA, helping you take full advantage of these opportunities.

What Are College Grants?

College grants are need-based or merit-based financial aid awards that students do not have to repay. They are typically provided by federal and state governments, private organizations, and colleges themselves. Grants can be awarded based on financial need, academic achievement, demographics, career aspirations, or other criteria.

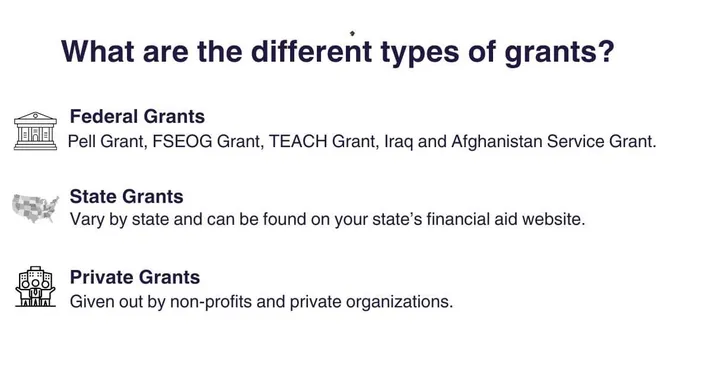

Types of Grants Available for College Students

There are several types of grants available for college students in the USA. Below are the most common categories:

1. Federal Grants

The U.S. Department of Education offers various grants to help students afford college. These grants are typically need-based and awarded based on the information provided on the Free Application for Federal Student Aid (FAFSA).

Pell Grant

The Pell Grant is the largest federal grant program for undergraduate students with exceptional financial need. For the 2024-2025 academic year, the maximum Pell Grant award is $7,395. The amount awarded depends on the student’s financial situation, cost of attendance, and enrollment status.

Federal Supplemental Educational Opportunity Grant (FSEOG)

The FSEOG is available to students with exceptional financial need and is awarded by participating schools. Funding is limited, so it’s important to apply early. Grant amounts range from $100 to $4,000 per year.

TEACH Grant

The Teacher Education Assistance for College and Higher Education (TEACH) Grant is for students who plan to become teachers in high-need subject areas in low-income schools. Recipients must agree to work in a qualifying school for at least four years, or the grant converts into a loan.

Iraq and Afghanistan Service Grant

This grant is for students whose parent or guardian died as a result of military service in Iraq or Afghanistan after 9/11. The award amount is equivalent to the maximum Pell Grant.

2. State Grants

Many states offer their own grant programs to help residents afford college. These grants are usually need-based, but some states also offer merit-based grants.

Examples of state grant programs include:

- Cal Grant (California) – Provides financial aid for students attending college in California.

- TAP (New York Tuition Assistance Program) – Helps New York residents attending eligible in-state institutions.

- MAP Grant (Monetary Award Program in Illinois) – Assists low-income students in Illinois.

To apply for state grants, students typically need to submit the FAFSA and sometimes a state-specific financial aid application.

3. Institutional Grants

Colleges and universities often provide grants to students based on financial need or academic merit. These grants can vary widely in terms of eligibility and award amounts.

Examples of institutional grants:

- Need-Based Institutional Grants – Schools analyze financial need based on the FAFSA or CSS Profile and offer grants to students who qualify.

- Merit-Based Grants – Some institutions award grants to students based on high academic achievement, leadership, or extracurricular involvement.

4. Private and Nonprofit Grants

Many private organizations, nonprofit foundations, and professional associations offer grants to students based on various criteria such as field of study, ethnicity, gender, or career goals.

Examples include:

- The Gates Millennium Scholars Program – Provides grants to outstanding minority students.

- The Coca-Cola Scholars Foundation – Offers financial aid to high-achieving students.

- The Hispanic Scholarship Fund – Assists Hispanic students pursuing higher education.

How to Apply for College Grants

1. Complete the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the most critical step in securing grants. The FAFSA determines eligibility for federal grants, state grants, and some institutional aid. Be sure to complete it as early as possible, as some grants have limited funds and are awarded on a first-come, first-served basis.

2. Research State and Institutional Grants

Visit your state’s higher education website to learn about available grants and their application requirements. Check with your college’s financial aid office for institutional grants you may qualify for.

3. Search for Private Grants and Scholarships

Use scholarship search engines such as Fastweb, Scholarships.com, and College Board’s Scholarship Search to find private grants that match your qualifications. Many organizations have unique eligibility requirements, so apply to as many as possible.

4. Write Strong Applications

Some private and institutional grants require essays, recommendation letters, or personal statements. Take time to craft compelling applications that highlight your strengths, achievements, and financial need.

Tips for Maximizing Grant Opportunities

- Apply Early: Many grants have limited funds and deadlines that come quickly. Submit applications as soon as they open.

- Maintain Good Academic Standing: Some grants require recipients to maintain a certain GPA or complete a specific number of credit hours.

- Renew Your FAFSA Annually: Federal and state grants require students to reapply each year.

- Seek Guidance: Contact your school’s financial aid office or academic advisors for help navigating the grant application process.

- Look for Specialized Grants: There are grants for women, minorities, students with disabilities, and those pursuing specific careers (such as STEM or teaching).

Final Thoughts

Grants are an excellent way to reduce the financial burden of higher education without accumulating debt. By exploring federal, state, institutional, and private grant opportunities, students can maximize their financial aid and make college more affordable.

Start early, stay informed, and take advantage of every grant opportunity available. Education is an investment in your future, and grants can help ensure you achieve your academic and career goals without the weight of excessive student debt.