Financing higher education in the United States can be a daunting challenge, especially with the rising costs of tuition, housing, and other associated expenses. While federal student loans are a great first choice due to their low interest rates and flexible repayment options, they may not always cover the full cost of attendance. This is where private student loans come into play.

Private student loans can bridge the gap between what federal aid covers and your total education costs. However, not all private lenders are the same. Finding the right private student loan can make a significant difference in your financial future. In this guide, we’ll explore the best private student loans in the USA, what to look for in a lender, and how to choose the best loan for your needs.

What Are Private Student Loans?

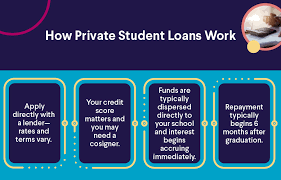

Private student loans are non-federal loans provided by banks, credit unions, and online lenders. Unlike federal loans, which are backed by the government, private loans rely on the borrower’s creditworthiness. This means interest rates, loan terms, and benefits can vary widely from lender to lender.

Key Differences Between Private and Federal Student Loans

- Credit-Based Approval: Unlike federal student loans, private lenders require a credit check, and interest rates depend on your credit score.

- Variable or Fixed Interest Rates: Private loans may have variable interest rates, which can fluctuate over time, unlike federal loans that offer fixed rates.

- Fewer Repayment Options: Federal loans offer income-driven repayment plans and loan forgiveness programs, while private loans typically do not.

- Higher Borrowing Limits: Private student loans can cover up to 100% of tuition and other education-related expenses, which can be beneficial for students attending expensive schools.

Best Private Student Loans in the USA

To help you make an informed decision, we have compiled a list of the best private student loans based on factors like interest rates, repayment flexibility, customer service, and borrower benefits.

1. Sallie Mae

Best for: Flexible Repayment Options

Sallie Mae is one of the most well-known private student loan providers. They offer competitive interest rates and multiple repayment options to fit different financial situations.

Pros:

- No origination fees or prepayment penalties

- Offers a variety of repayment plans, including deferred, fixed, and interest-only options while in school

- Co-signer release option after 12 months of consecutive, on-time payments

- Available for undergraduate, graduate, and professional students

Cons:

- Requires good credit or a co-signer for the best rates

- Limited deferment options compared to federal loans

2. College Ave

Best for: Customizable Loan Terms

College Ave stands out for its flexibility in repayment terms and personalized loan options.

Pros:

- Customizable repayment terms from 5 to 15 years

- Offers both fixed and variable interest rates

- No application or prepayment fees

- Co-signer release available after 24 months of on-time payments

Cons:

- Requires a good credit score for the lowest rates

- No dedicated loan forgiveness program

3. Earnest

Best for: Borrowers with Strong Credit

Earnest is known for offering low interest rates to creditworthy borrowers and has flexible repayment options.

Pros:

- No fees (no origination, prepayment, or late fees)

- Allows borrowers to skip one payment per year if needed

- Offers a grace period of 9 months after graduation (longer than most lenders)

- High approval rates for borrowers with strong credit

Cons:

- No co-signer release program

- Not available in all states

4. Discover Student Loans

Best for: No Fees and Rewards for Good Grades

Discover provides student loans with no fees and a unique cash reward for students who maintain good grades.

Pros:

- No fees (origination, late, or prepayment fees)

- 1% cash back reward for students with a GPA of 3.0 or higher

- Multiple repayment options

- 15-year loan term for undergraduate students

Cons:

- Requires a strong credit score or a co-signer

- No co-signer release option

5. Citizens Bank

Best for: Multi-Year Approval

Citizens Bank offers a unique multi-year approval feature, allowing students to secure financing for multiple years at once.

Pros:

- Multi-year approval helps reduce the need to apply for loans each year

- Co-signer release available after 36 months

- Fixed and variable interest rate options

- Offers loyalty discounts for existing customers

Cons:

- Requires a high credit score for the lowest rates

- Fewer repayment options compared to competitors

How to Choose the Best Private Student Loan

When selecting a private student loan, consider the following factors:

1. Interest Rates

- Compare fixed and variable rates among different lenders.

- Look for the lowest possible rate based on your credit profile.

2. Loan Terms

- Check the repayment period (5, 10, or 15 years) and choose one that aligns with your financial goals.

3. Fees

- Look for lenders that do not charge origination fees, prepayment penalties, or late fees.

4. Repayment Options

- Choose a lender that offers flexibility, such as deferment while in school, interest-only payments, or income-based repayment options.

5. Co-Signer Requirements

- If you don’t have strong credit, a co-signer may be necessary to secure the best interest rates.

- Look for lenders that offer a co-signer release option after a set number of on-time payments.

Final Thoughts

Private student loans can be a valuable resource for financing your education when federal aid falls short. However, they come with varying terms, interest rates, and benefits, so it’s essential to shop around and compare lenders before making a decision.

Start by exploring federal options first, as they offer more borrower protections. If you still need additional funding, consider the private lenders mentioned above based on your needs and financial circumstances. By making an informed choice, you can minimize debt and ensure a financially secure future after graduation.

Frequently Asked Questions (FAQs)

1. Are private student loans better than federal loans? No, federal student loans typically offer better protections, lower fixed interest rates, and flexible repayment options. Private loans should be considered only after exhausting federal aid options.

2. Can I get a private student loan without a co-signer? Yes, but you’ll need a strong credit score and steady income to qualify for competitive interest rates. Otherwise, a co-signer can help you secure better terms.

3. How do I apply for a private student loan? You can apply online through the lender’s website. The process typically involves a credit check, proof of enrollment, and sometimes income verification.

By understanding your options and making a smart borrowing decision, you can set yourself up for a successful financial future while pursuing higher education. Happy learning!