For young drivers, getting behind the wheel is an exciting milestone, but finding the right car insurance can be a daunting task. Insurance premiums for young drivers tend to be higher due to their lack of driving experience and higher risk of accidents. However, with the right approach, it is possible to find affordable and comprehensive coverage that suits your needs. In this guide, we’ll explore the best car insurance options for young drivers, factors affecting premiums, and tips to save money.

Why Is Car Insurance Expensive for Young Drivers?

Young drivers, especially those under 25, are considered high-risk by insurance companies. Statistics show that they are more likely to be involved in accidents compared to older, more experienced drivers. As a result, insurance providers charge higher premiums to offset this risk. Some factors that contribute to higher insurance costs include:

- Lack of Driving Experience: Less experience means a higher likelihood of making mistakes on the road.

- Higher Accident Rates: Studies show that young drivers are involved in more accidents than older drivers.

- Tendency for Risky Behavior: Speeding, distracted driving, and lack of seat belt use are more common among younger drivers.

- Expensive Car Choices: Some young drivers opt for high-performance vehicles, which are costlier to insure.

How to Find the Best Car Insurance for Young Drivers

Finding affordable car insurance requires a combination of research, smart choices, and taking advantage of discounts. Here are some of the best insurance providers that offer competitive rates and benefits for young drivers:

1. Geico

Geico is a well-known provider that offers competitive rates for young drivers. They provide several discounts, including:

- Good Student Discount: If you maintain a high GPA, you can save money.

- Defensive Driving Discount: Completing a driving course can reduce your premium.

- Family Plan Savings: Being on a parent’s policy often leads to lower rates.

2. State Farm

State Farm is another excellent option, particularly for students. Their Steer Clear® program is designed for drivers under 25 and provides discounts for completing safe driving courses and logging driving hours.

Other benefits include:

- Good Student Discounts

- Accident-Free Discount

- Multiple Policy Savings (if you bundle with renters or homeowners insurance)

3. Progressive

Progressive offers competitive rates and unique programs like Snapshot®, which tracks driving habits using a mobile app or plug-in device. Safe drivers can earn significant discounts.

Key benefits:

- Customizable Coverage Options

- Accident Forgiveness

- Usage-Based Discounts for safe driving habits

4. Allstate

Allstate provides affordable insurance for young drivers with several ways to save:

- Smart Student Discount for students with good grades

- TeenSMART® Driver Education Program that rewards safe driving

- Pay-Per-Mile Insurance (ideal for drivers who don’t drive frequently)

5. USAA (For Military Families)

If you or your family are affiliated with the military, USAA is one of the best options available. They offer:

- Lower-than-average premiums

- Accident Forgiveness

- Safe Driving Discounts

Tips to Save Money on Car Insurance as a Young Driver

Even though insurance for young drivers is typically expensive, there are several ways to lower your costs:

1. Stay on a Parent’s Policy

If possible, remain on a parent’s policy instead of purchasing your own. This can lead to significantly lower rates compared to having a separate policy.

2. Choose a Safe and Affordable Car

Opt for a car with a high safety rating, low repair costs, and anti-theft features. Vehicles like sedans or compact SUVs tend to have lower insurance premiums compared to sports cars or luxury vehicles.

3. Take Advantage of Discounts

Ask your insurance provider about available discounts, such as:

- Good Student Discount (for maintaining a GPA of 3.0 or higher)

- Defensive Driving Course Discount

- Low Mileage Discount (if you don’t drive often)

- Bundling Discounts (combining auto and renters insurance)

4. Improve Your Credit Score

Some states allow insurance companies to use credit scores to determine premiums. Building good credit can lead to lower insurance rates.

5. Increase Your Deductible

Choosing a higher deductible (the amount you pay out of pocket before insurance kicks in) can lower your monthly premiums. However, ensure you can afford the deductible in case of an accident.

6. Drive Safely

The best way to keep your insurance costs low is to maintain a clean driving record. Avoid speeding, distracted driving, and reckless behavior to prevent accidents and traffic violations.

7. Compare Quotes from Multiple Insurers

Insurance rates vary from company to company, so it’s crucial to get quotes from multiple providers to find the best deal.

Best Types of Coverage for Young Drivers

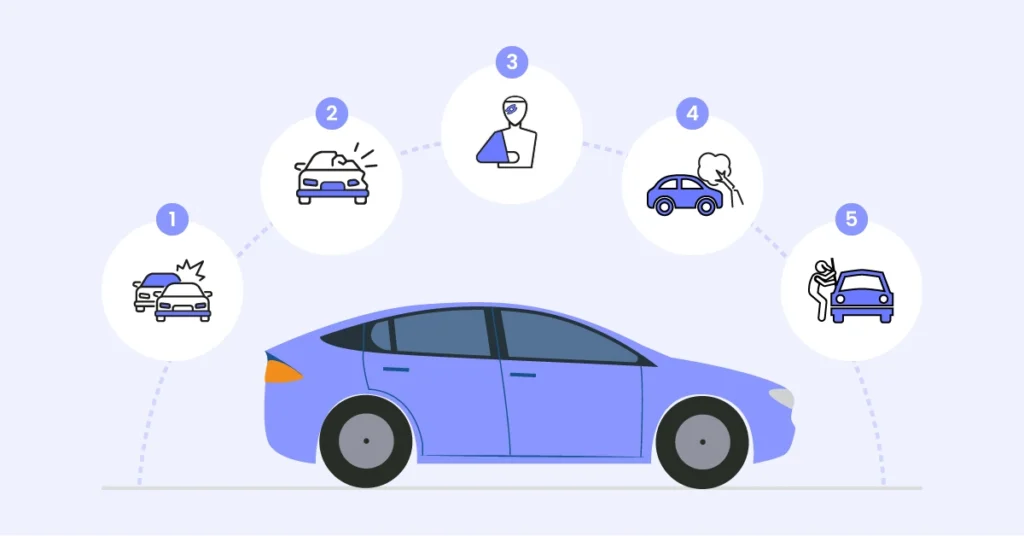

When purchasing car insurance, young drivers should consider the following types of coverage:

- Liability Insurance: Covers damage to other people and their property if you’re at fault in an accident. Most states require this coverage.

- Collision Coverage: Pays for damage to your own car in case of an accident, regardless of fault.

- Comprehensive Coverage: Covers damage from non-collision incidents such as theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident caused by a driver with little or no insurance.

- Roadside Assistance: Helps with towing, flat tires, and lockouts, which can be useful for young drivers.

Final Thoughts

Finding the best car insurance as a young driver may seem challenging, but with research and smart choices, you can secure affordable and reliable coverage. Consider providers like Geico, State Farm, Progressive, Allstate, and USAA if you qualify. Take advantage of discounts, drive safely, and compare quotes to get the best possible deal.

By following these tips, young drivers can navigate the road with confidence, knowing they are protected without overpaying for insurance.