Home insurance is one of the most critical financial safeguards for homeowners, providing protection against unexpected damages, natural disasters, theft, and liability claims. However, choosing the right home insurance policy can be overwhelming due to the variety of options available.

In this guide, we will break down the key aspects of comparing home insurance policies, helping you make an informed decision and ensuring your home and valuables are adequately protected.

Understanding Home Insurance Policies

Before diving into a comparison, it’s essential to understand the core components of a home insurance policy. A standard home insurance policy typically includes:

- Dwelling Coverage: Protects the structure of your home from damages caused by perils such as fire, storms, and vandalism.

- Personal Property Coverage: Covers your belongings, such as furniture, electronics, and clothing, if they are damaged, destroyed, or stolen.

- Liability Protection: Provides coverage in case someone is injured on your property and you are found legally responsible.

- Additional Living Expenses (ALE): Helps cover temporary living costs if your home becomes uninhabitable due to a covered event.

- Other Structures Coverage: Protects structures on your property that are not attached to your home, like fences, garages, and sheds.

Now that we understand what a standard home insurance policy includes, let’s explore the factors that differentiate policies.

Key Factors to Compare in Home Insurance Policies

When comparing home insurance policies, there are several factors to consider to ensure you’re getting the best value for your needs.

1. Coverage Limits and Exclusions

Not all policies provide the same level of protection. Some may have lower coverage limits or exclude specific types of damages. Check:

- Maximum coverage limits for dwelling, personal property, and liability.

- Any exclusions for natural disasters such as earthquakes, floods, or hurricanes.

- Coverage for high-value items like jewelry, art, or collectibles.

2. Premium Costs and Deductibles

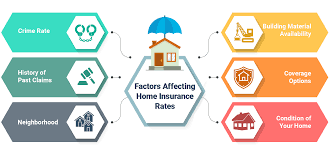

The cost of home insurance varies based on several factors, including location, home value, and coverage levels. When comparing policies:

- Look at the monthly or annual premium costs.

- Consider the deductible – the amount you must pay out-of-pocket before insurance kicks in. A higher deductible usually means lower premiums, but more expense when filing a claim.

- Check for discounts offered by insurers (e.g., bundling home and auto insurance, security system installation, or loyalty discounts).

3. Replacement Cost vs. Actual Cash Value

There are two ways insurance companies assess the value of your belongings and home:

- Replacement Cost Coverage (RCV): Covers the cost to repair or replace your home and belongings at today’s prices.

- Actual Cash Value (ACV): Takes depreciation into account, meaning the payout will be lower than the original purchase price.

For better financial protection, RCV is generally preferred, though it may come with higher premiums.

4. Customer Service and Claim Process

In times of crisis, you want an insurer that is reliable and provides a smooth claims process. Consider:

- Customer service reviews and complaint records.

- Claim response time and ease of filing a claim.

- Availability of 24/7 customer support and digital claim submission options.

5. Additional Coverage Options (Endorsements/Riders)

Some insurers offer additional coverages (endorsements or riders) that can enhance your policy, such as:

- Flood Insurance: Required if you live in a high-risk flood zone.

- Earthquake Insurance: Recommended for those in seismic-prone areas.

- Water Backup Coverage: Covers damage caused by sewer or drain backups.

- Identity Theft Protection: Provides financial assistance if you become a victim of identity theft.

Comparing Top Home Insurance Providers

To help you get started, here’s a general comparison of some of the leading home insurance providers in the U.S. (Note: Exact details vary based on location and personal circumstances.)

| Provider | Best For | Key Features |

|---|---|---|

| State Farm | Overall Coverage | High customer satisfaction, bundling discounts, strong financial backing |

| Allstate | Customization | Many add-on coverages, claim satisfaction guarantee |

| Geico | Budget-Friendly | Competitive pricing, online policy management |

| USAA | Military Families | Exclusive for military members, superior customer service |

| Progressive | Discounts | Multiple discount options, flexible coverage |

| Farmers | High-Value Homes | Comprehensive coverage, customizable options |

Tips for Choosing the Right Home Insurance Policy

After comparing policies, keep the following tips in mind when selecting the best one for your needs:

- Assess Your Needs: Consider the value of your home, belongings, and risk factors (e.g., location, crime rate, weather conditions).

- Shop Around: Get quotes from at least three different insurers to compare pricing and coverage.

- Understand the Fine Print: Read the policy details, including exclusions and conditions, before making a decision.

- Consider Bundling: Many insurance providers offer discounts for bundling home and auto insurance.

- Ask About Discounts: Inquire about potential savings through home improvements, security systems, or claim-free history.

Conclusion

Finding the right home insurance policy requires careful comparison of coverage options, costs, customer service, and additional benefits. By taking the time to analyze policies based on your specific needs, you can secure the best protection for your home and peace of mind.

If you’re in the market for home insurance, start by gathering quotes and speaking with insurance representatives to clarify any doubts. A well-informed decision today can save you from financial stress in the future. Happy house hunting and stay protected!