Introduction

Running a business comes with its share of risks. Whether you’re a small business owner or managing a large enterprise, one unexpected lawsuit or accident can drain your finances. That’s where business liability insurance comes in—it helps protect you against financial losses from legal claims. However, many business owners wonder: How much does business liability insurance cost? The answer isn’t one-size-fits-all, as it depends on various factors, from industry type to policy limits.

In this guide, we will break down everything you need to know about business liability insurance costs, what influences the price, and how you can save money while ensuring adequate coverage.

What is Business Liability Insurance?

Business liability insurance, often referred to as general liability insurance, is a policy that protects businesses against claims of bodily injury, property damage, personal injury, and advertising injury. This type of insurance helps cover legal fees, settlements, and medical expenses in case your business is found liable for damages.

There are different types of business liability insurance, including:

- General Liability Insurance – Covers third-party bodily injuries, property damage, and advertising injury claims.

- Professional Liability Insurance (Errors & Omissions Insurance) – Covers negligence claims related to professional services.

- Product Liability Insurance – Protects against claims of defective products that cause injury or damage.

- Commercial Property Insurance – Covers damages to your business property.

The type of liability insurance you need depends on your industry, business operations, and potential risks.

How Much Does Business Liability Insurance Cost?

The cost of business liability insurance varies widely based on several factors. However, on average, small businesses pay between $300 and $5,000 per year for general liability insurance, depending on the coverage amount and risk factors.

Factors That Affect Business Liability Insurance Cost

Several key factors determine how much you’ll pay for business liability insurance:

1. Industry & Business Type

Your industry plays a significant role in determining your insurance cost. Businesses with higher risks—like construction companies or manufacturing firms—will have higher premiums than a low-risk business, such as a consulting firm.

- A construction company may pay $2,000 to $10,000 per year due to high-risk activities.

- A retail store may pay $500 to $2,500 per year based on customer foot traffic.

- A freelance consultant may pay as little as $300 per year since their risk of liability is minimal.

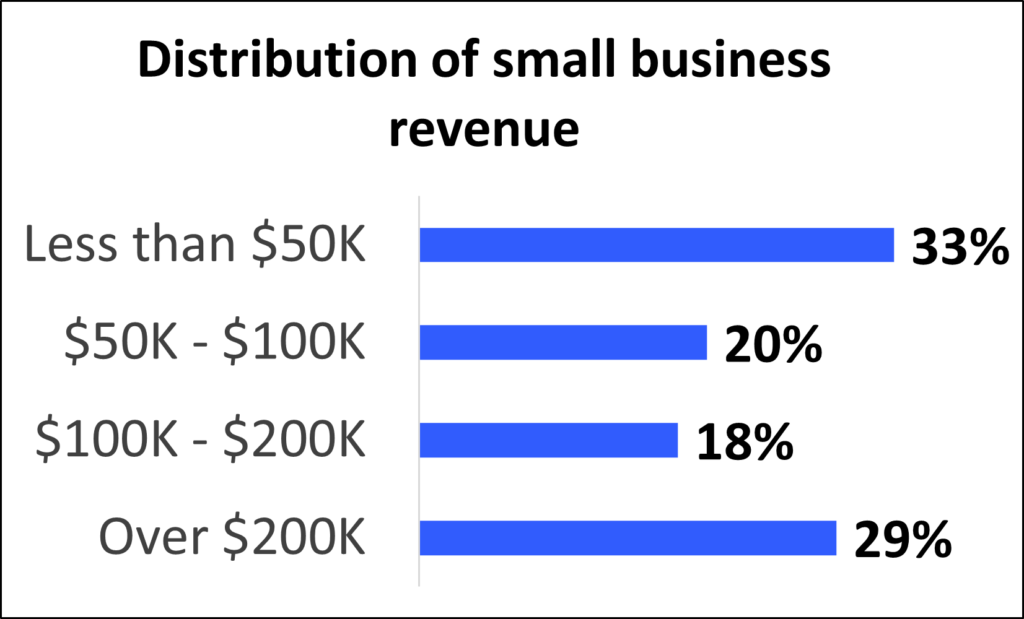

2. Business Size & Revenue

Larger businesses or those generating higher revenue typically pay more for insurance. This is because a business with more clients, employees, or customers has a higher chance of being sued.

3. Location

Your business’s location impacts insurance costs. Businesses in cities with higher litigation rates or expensive real estate may face higher premiums. For example, insurance in New York or California may cost more than in rural areas.

4. Coverage Limits & Policy Deductibles

The higher the coverage limits, the higher the cost. Businesses choosing a $1 million policy will pay less than those opting for a $5 million policy. Similarly, a higher deductible reduces premiums but increases out-of-pocket expenses when filing a claim.

5. Claims History

Businesses with a history of claims or lawsuits will likely face higher premiums. Insurance companies assess risk based on past claims to determine future liabilities.

6. Number of Employees

A company with more employees has a higher exposure to workplace injuries or legal disputes, increasing liability insurance costs.

7. Business Experience

Startups and new businesses might pay higher premiums than established businesses with a solid track record of safe operations.

Average Cost of Business Liability Insurance by Business Type

| Business Type | Estimated Annual Cost |

|---|---|

| Consultants & Freelancers | $300 – $1,000 |

| Retail Stores | $500 – $2,500 |

| Restaurants | $1,000 – $5,000 |

| Contractors | $2,000 – $10,000 |

| Healthcare Providers | $3,000 – $15,000 |

| Manufacturing | $5,000 – $20,000 |

These costs vary based on policy coverage, location, and additional factors.

How to Reduce Business Liability Insurance Costs

While insurance is a necessary expense, there are ways to lower your premiums:

1. Compare Quotes from Multiple Insurers

Insurance costs vary among providers. Get at least three quotes from different companies to find the best price.

2. Bundle Policies

Many insurers offer Business Owner’s Policies (BOPs) that combine general liability insurance with property insurance at a lower rate.

3. Improve Workplace Safety

Implementing safety training and risk management strategies can help reduce claims, lowering your insurance costs over time.

4. Increase Your Deductible

Opting for a higher deductible can lower your monthly premium. However, ensure you can afford the deductible in case of a claim.

5. Maintain a Clean Claims History

Avoid frequent claims by following best business practices and reducing liability risks.

6. Ask for Discounts

Some insurers offer discounts for low-risk businesses, long-term clients, or businesses with no prior claims.

Choosing the Right Business Liability Insurance

Finding the right liability insurance requires assessing your business risks and budget. Here are some key steps to follow:

- Identify Your Risks – Determine potential liabilities specific to your industry.

- Compare Multiple Insurers – Check coverage options and customer reviews.

- Select the Right Coverage Limits – Don’t underinsure; ensure you have adequate protection.

- Read the Policy Carefully – Understand exclusions and coverage details before purchasing.

- Consult an Insurance Broker – A professional can help you navigate complex policies and find the best deal.

Conclusion

Business liability insurance is an essential investment that protects your company from financial losses due to lawsuits or accidents. While costs vary based on factors like industry, business size, and location, taking proactive steps—such as comparing quotes, bundling policies, and improving workplace safety—can help you reduce premiums.

Ultimately, choosing the right insurance policy is about balancing cost and coverage. Make informed decisions to safeguard your business and its future growth.

Need Help Choosing a Business Liability Insurance Policy? Reach out to professional insurance advisors to get tailored recommendations and cost-effective solutions for your business!