Introduction

Life insurance is one of the most important financial decisions you can make for yourself and your loved ones. It provides a safety net that ensures your family is financially secure in the event of your passing. However, the process of getting a life insurance policy can often seem complicated and overwhelming. Thankfully, the internet has simplified this process, making it easier than ever to compare life insurance quotes online and find a policy that suits your needs and budget.

In this guide, we’ll explore everything you need to know about getting life insurance quotes online, why it’s a smart choice, and how to navigate the process efficiently.

What Are Life Insurance Quotes?

A life insurance quote is an estimate of how much you’ll pay for a policy based on certain factors such as age, health, coverage amount, and term length. These quotes help you compare different policies and providers to find the best deal for your situation.

There are two main types of life insurance policies:

- Term Life Insurance – Provides coverage for a specific period (e.g., 10, 20, or 30 years) and is generally more affordable.

- Permanent Life Insurance – Includes whole life and universal life insurance, offering lifelong coverage with a cash value component.

When looking for life insurance quotes online, you’ll typically be asked to enter some basic information to receive an estimate of potential premiums.

Why Get Life Insurance Quotes Online?

With so many insurance providers in the market, comparing life insurance policies manually can be time-consuming and frustrating. Online tools have revolutionized this process, making it easier and more convenient. Here’s why getting life insurance quotes online is a smart choice:

1. Convenience

Gone are the days of scheduling multiple meetings with insurance agents. With online life insurance quote tools, you can receive quotes in minutes from the comfort of your home.

2. Time-Saving

Comparing different insurance providers manually can take days or even weeks. Online platforms provide instant quotes, helping you save valuable time.

3. Cost Comparison

By using an online quote comparison tool, you can see different rates from multiple providers at once. This ensures that you get the best deal available.

4. No Pressure Sales Tactics

When working with traditional insurance agents, you may feel pressured to make a decision. Online platforms allow you to research at your own pace without external influence.

5. Access to Discounts

Many insurance providers offer exclusive discounts for policies purchased online. By shopping for quotes digitally, you may be able to take advantage of these savings.

How to Get Accurate Life Insurance Quotes Online

While online quotes are a great way to estimate costs, they are only as accurate as the information you provide. Here are a few tips to ensure you get the best possible quotes:

1. Provide Honest and Accurate Information

Insurance companies calculate your premium based on your age, health history, smoking habits, occupation, and other factors. Being honest about these details ensures you get a quote that accurately reflects your potential policy costs.

2. Determine Your Coverage Needs

Before getting quotes, assess your financial situation to determine how much coverage you need. Consider factors such as outstanding debts, mortgage, future education costs for your children, and income replacement.

3. Compare Multiple Providers

Different insurance companies use varying methods to calculate premiums. Always compare quotes from multiple providers to ensure you’re getting the best rate for your coverage needs.

4. Understand Policy Terms and Conditions

Make sure you understand the policy’s terms before making a decision. Look into aspects like renewal options, exclusions, and riders (additional coverage options) to ensure the policy aligns with your needs.

5. Check Reviews and Ratings

A cheap policy isn’t always the best. Read customer reviews and check the insurer’s financial stability rating (from agencies like AM Best or Moody’s) to ensure they can pay out claims when needed.

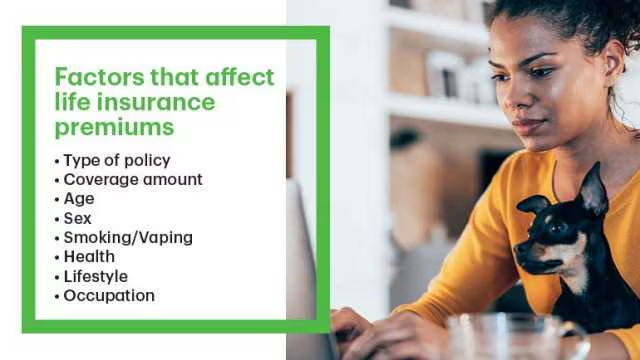

Common Factors That Influence Life Insurance Quotes

When you receive a life insurance quote online, several factors impact the premium you’re offered. Understanding these can help you better prepare for the application process.

- Age – Younger individuals typically pay lower premiums as they are considered lower risk.

- Health Condition – Pre-existing conditions, such as diabetes or heart disease, can increase premiums.

- Lifestyle Choices – Smoking, excessive alcohol use, and risky hobbies (e.g., skydiving) can lead to higher costs.

- Coverage Amount – The higher the coverage amount, the more expensive the policy.

- Policy Type – Term life insurance is generally cheaper than whole or universal life insurance.

- Family Medical History – A family history of certain diseases can impact your quote.

- Occupation – High-risk jobs (e.g., firefighters, pilots) may lead to higher premiums.

Steps to Purchase a Life Insurance Policy Online

Once you’ve compared quotes and found a policy that suits you, follow these steps to secure your coverage:

1. Choose Your Preferred Insurer

After comparing quotes, select a reputable insurance provider with favorable rates and strong customer reviews.

2. Complete the Application

Most insurers allow you to complete an application online. You may need to provide additional details about your medical history and lifestyle.

3. Undergo a Medical Exam (If Required)

Some policies require a medical exam, which may include blood tests, urine tests, and a general health checkup. Some insurers offer no-medical-exam policies, but these usually come with higher premiums.

4. Wait for Approval

Once your application is submitted, the insurer will review your details and determine final pricing. This process may take a few days to several weeks.

5. Review and Accept the Policy

Once approved, carefully review the policy details. If everything looks good, accept the policy and start making premium payments.

Conclusion

Getting life insurance quotes online is a quick, efficient, and hassle-free way to find the best policy for your needs. By using online comparison tools, you can save time, compare costs, and secure a policy that ensures your loved ones’ financial stability.

If you haven’t already, take the first step today by getting a life insurance quote online. It’s never too early to plan for your future, and having a reliable policy in place can give you peace of mind knowing your family is protected no matter what happens.