Health insurance is an essential part of financial security, yet many people struggle to find affordable plans that provide adequate coverage. With rising healthcare costs, it can feel overwhelming to navigate the sea of options available. The good news is that there are ways to secure cheap health insurance plans without sacrificing the protection you need. This guide will walk you through everything you need to know about finding budget-friendly health insurance.

Why Health Insurance Is Important

Before we dive into affordable health insurance options, let’s discuss why having coverage is so crucial. Health insurance helps cover the cost of medical expenses, from routine check-ups to emergency hospital visits. Without it, even a simple doctor’s visit can result in hefty bills. Additionally, insurance provides access to preventive care, which can help catch health issues early and reduce long-term medical costs.

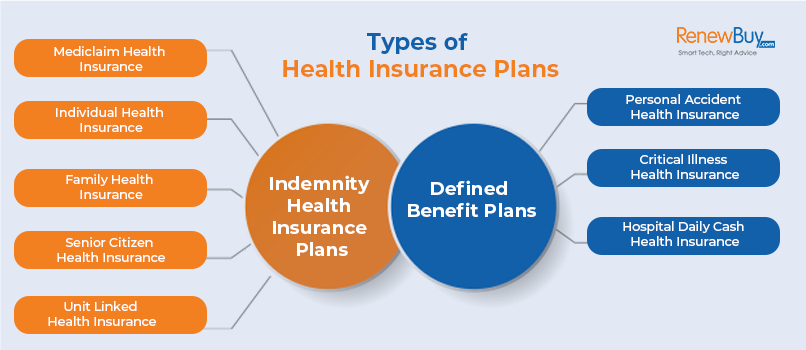

Understanding Different Types of Health Insurance Plans

When searching for affordable health insurance, it’s essential to understand the different types of plans available. Each plan has its pros and cons, so finding the right one for your needs is key.

1. Health Maintenance Organization (HMO) Plans

HMO plans are usually the most affordable but come with limitations. They require you to select a primary care physician (PCP) who coordinates your healthcare. You must get referrals from your PCP to see specialists, and you can only visit doctors within the network.

2. Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility, allowing you to see specialists without a referral and visit out-of-network providers. However, they tend to have higher premiums and out-of-pocket costs compared to HMOs.

3. Exclusive Provider Organization (EPO) Plans

EPO plans are similar to HMOs but don’t require referrals for specialists. However, they still require you to use a network of healthcare providers, making them slightly more restrictive than PPOs.

4. High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

HDHPs come with lower monthly premiums but have higher deductibles. They are often paired with HSAs, which allow you to save money tax-free for medical expenses.

5. Join a Group or Association Plan

Some professional organizations and trade groups offer health insurance plans at discounted rates. If you’re self-employed or don’t have employer-sponsored insurance, this could be a viable alternative.

6. Consider a High-Deductible Plan with an HSA

If you’re relatively healthy and don’t anticipate frequent doctor visits, an HDHP combined with an HSA can be a smart way to save on insurance costs while enjoying tax benefits.

7. Negotiate and Ask About Discounts

Some insurance companies offer discounts for non-smokers, people who maintain a healthy lifestyle, or those who pay their premiums annually instead of monthly. Always ask about possible savings opportunities.

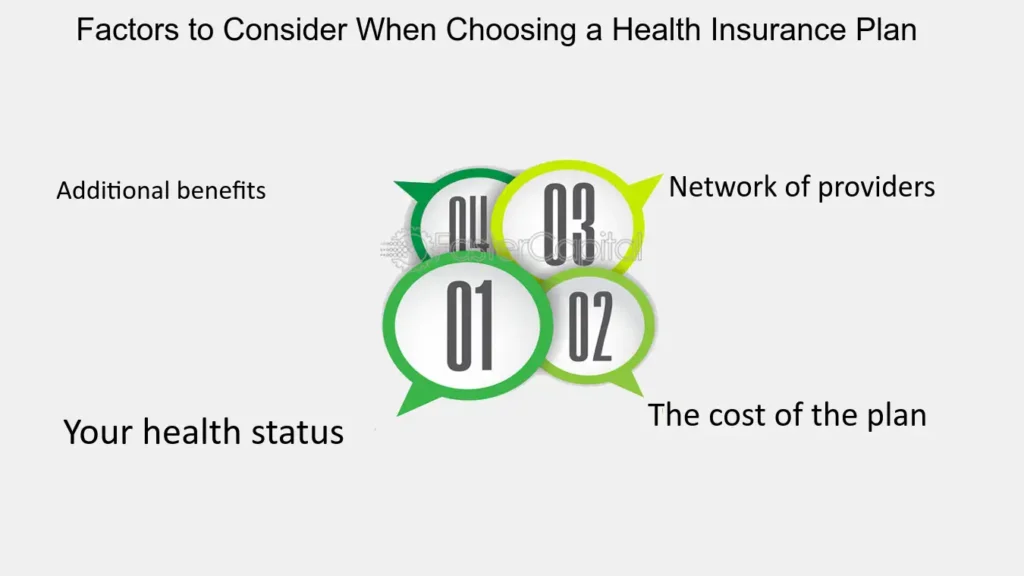

What to Watch Out for When Choosing a Cheap Health Insurance Plan

While affordability is important, choosing the cheapest plan isn’t always the best option. Here are some key factors to consider:

1. Coverage Limitations

Make sure the plan covers essential health benefits such as doctor visits, hospital stays, prescription drugs, and preventive care. Some cheaper plans may exclude critical services.

2. High Out-of-Pocket Costs

A plan with low premiums might have high deductibles, co-pays, and co-insurance, which could end up costing more in the long run. Calculate your potential annual healthcare costs before committing.

3. Provider Network Restrictions

If you have a preferred doctor or medical facility, ensure they’re included in the plan’s network. Going out-of-network can lead to significantly higher expenses.

4. Prescription Drug Coverage

If you take medications regularly, review the plan’s drug formulary to confirm that your prescriptions are covered at an affordable rate.

5. Pre-existing Condition Exclusions

Under ACA-compliant plans, pre-existing conditions must be covered. However, short-term and some private plans may exclude or charge higher rates for these conditions.

Final Thoughts

Finding a cheap health insurance plan requires careful consideration, but it’s possible to get good coverage at an affordable price. Start by comparing plans on the marketplace, exploring government assistance programs, and reviewing employer-sponsored options. Always check the details of each policy to ensure it meets your healthcare needs without unexpected costs.

Investing in health insurance now can save you from significant financial burdens later. Prioritize both affordability and quality coverage to ensure you and your family are protected. With the right approach, you can secure a health insurance plan that fits your budget without compromising on essential healthcare services.